Despite a persistently challenging environment for fixed-income investors, the sustainable bond market remained strong in 2023.Fixed income ESG outlook 2024 – Morgan Stanley Investment

Rachael Monteiro explains how WHEB’s approach to stewardship is based on quality over quantity, with a focus on materiality and positive impact.Stewardship in the spotlight: the stewardship stampede – WHEB

Peter Michaelis discusses the role of sustainable investment in addressing the climate challenge.The future of sustainable investment – video – Liontrust

Schroders new engagement blueprint for private markets sets out their approach to active ownership.Engagement blueprint for private markets – Schroders

Jupiter's Salman Siddiqui discusses the idea of introducing tayyib considerations into investment decisions in this joint paper with the Global Ethical…Shariah investing: the importance of tayyib – Jupiter Asset Management

Osmosis IM review the local regulatory landscapes in emerging markets.Emerging markets insights: sustainability disclosure regulations – Osmosis Investment Management

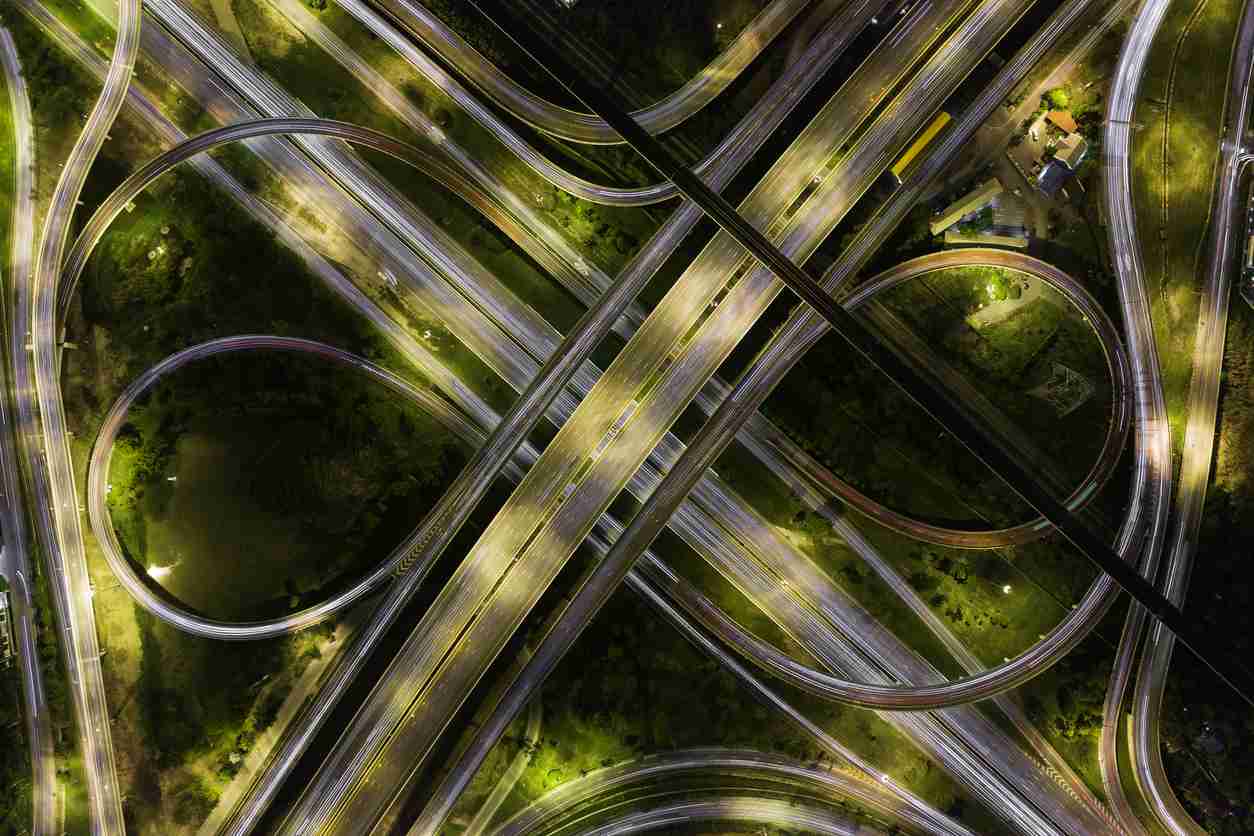

Sustainability issues lie at the heart of infrastructure investing, Roger Pim guides you through the diverse opportunities that will shape his investment…Infrastructure: how sustainability is focus of new investments – abrdn

Sustainable Investment Conference 2023. Electric vehicles and public transport.Safer, more efficient transport – video – Liontrust

Our focus needs to expand beyond decarbonisation towards the social, environmental and adaptation issues linked to climate change, says Eva Cairns. That’s…Sustainability: 3 reasons why we need to look beyond decarbonisation – abrdn

J.P. Morgan Asset Management has developed a Carbon Transition Score that incorporates the key implications of the Paris Agreement.A systematic tool to help identify leaders and laggards in the low carbon transition – J.P. Morgan Asset Management