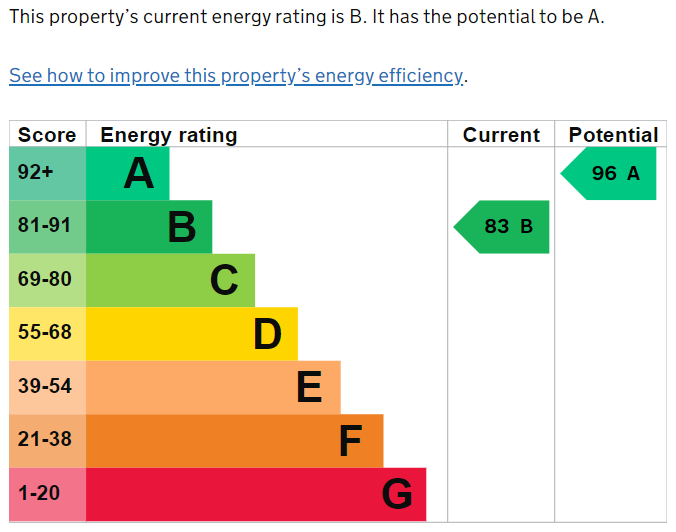

How can investors influence decarbonisation in private-rented housing?Not as easy as EPC – Hearthstone Investments

Achieving true sustainability in fixed income is no mean feat: it takes time, expertise, dedication and resources.SDG Engagement High Yield Credit, H1 2023 Report – Federated Hermes Limited

Carbon capture technology offers a proven and effective means to reduce carbon emissions, playing a pivotal role in addressing climate change and achieving…Innovations in carbon capture: turning emissions into opportunities – Rize ETF

Highlights from Clare Jervis' recent US research trip.A walk down Water Street – WHEB

Eric Carlson, Head of Sustainability and Portfolio Manager, Emerging Markets Equity, discusses energy transition opportunities with India’s largest independent…The energy transition opportunity in emerging markets – Morgan Stanley Investment Management

Head of Global Listed Real Assets, Laurel Durkay, shares her insights on environmental, social and governance factors across real estate sectors and geographies…Sustainable logistics and decarbonising real estate efforts across the globe - Morgan Stanley Investment Management

The crucial role for asset managers.Unleashing the potential of impact measurement in listed equities – WHEB

A glimpse into 2024.CIO outlook – Tikehau Capital

What does the opportunity around hydrogen look like? The experts at Schroders Greencoat explain in this Q&A.Hydrogen 101: the uses, the costs and the opportunity – Schroders

Schroders latest analysis of best practice includes the findings of a survey of 350 investee companies from 45 countries and their formula for successful…Active ownership: three ways to improve investor engagement – Schroders