Read our A-Z definitions to stay up to date with impact investment terminology.N for Natural Capital – A-Z of impact investing

As part of its commitment to achieving a climate-neutral economy by 2050, the EU introduced the EU Taxonomy for Sustainable Activities and the SFDR, which…The role of finance and the EU taxonomy in the circular economy part 1 – Rize ETF

Cattle ranching remains the main driver of deforestation in the Amazon, with land cleared for grazing or the production of soy for animal feed. Sonya Likhtman…Appetite for destruction – Federated Hermes Limited

In this episode, James Baldwin, Real Assets Researcher at LCP, talks about the future of infrastructure investing.Investment Uncut - The future of infrastructure with James Baldwin - podcast - LCP

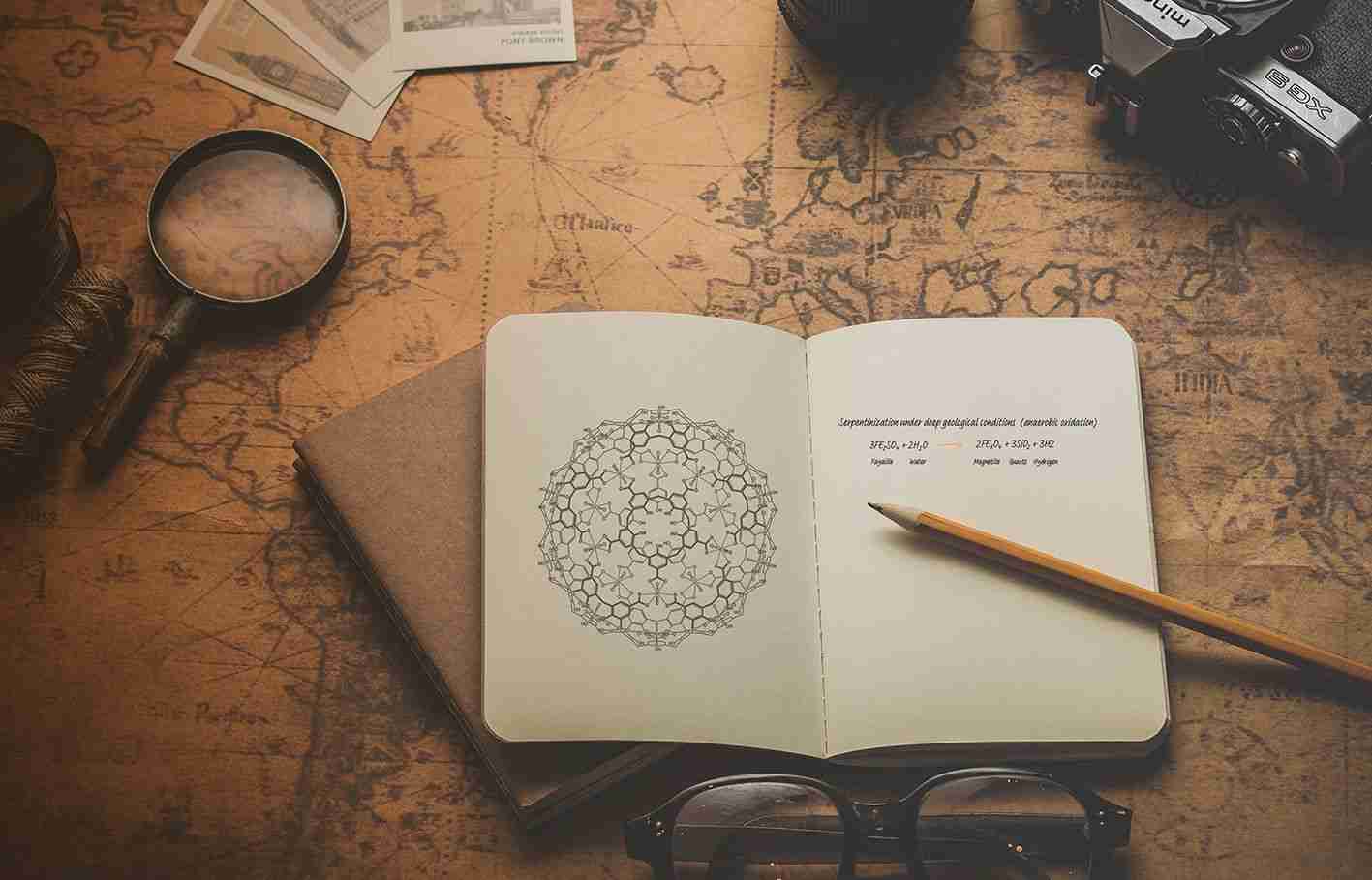

Hydrogen naturally and abundantly present in the subsurface is positioning itself as nature´s next treasure; a real solution for the energy transition.Sifting through the science and fiction in the hunt for nature´s treasure – Beam Earth

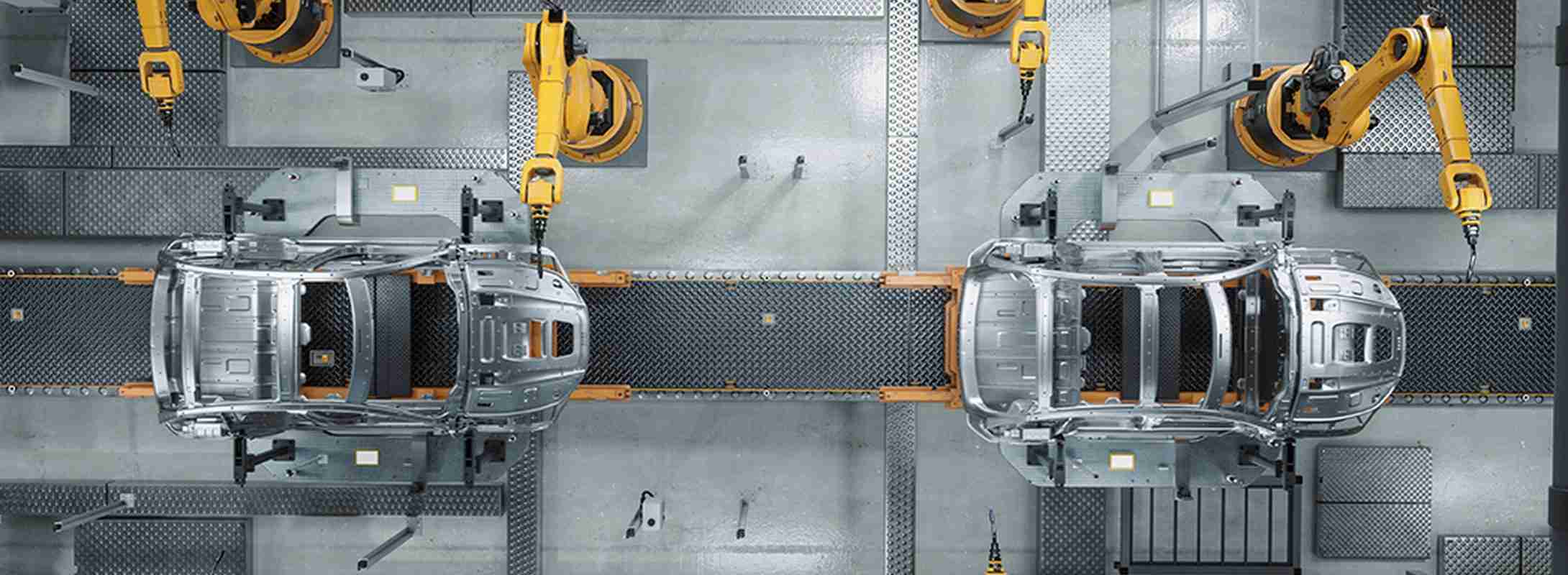

A key to the energy transition.Green hydrogen - you may not smell it, but it is coming – BNP Paribas Asset Management

EOS at Federated Hermes has published its third UK Stewardship Report as a service provider, with insights into their cost of living engagements and their…EOS Stewardship Report 2022 – Federated Hermes Limited

Invesco's 2022 UK Stewardship Code Report details how the firm is supporting good stewardship practices in the UK and beyond.2022 UK Stewardship Code Report – Invesco

LCP annual DB pensions conference.The power of pensions – video – LCP

On the occasion of World Ocean Day on 8 June, BNP Paribas Asset Management take a look at progress on policy and consider actions that can help promote…The ocean – worthy of investor attention – BNP Paribas Asset Management