Seb Beloe explains the two distinct, but complementary, types of impact measured at WHEB: ‘enterprise impact’ and ‘investor contribution’ referred to in…2022 Impact report – The age of adoption – WHEB

How the energy transition to renewables is expected to lead to a sharp increase in demand for minerals.Mining and the energy transition – J.P. Morgan Asset Management

How the climate crisis can be addressed through sovereign debt.EM sovereign debt 5.0: nature and climate – Natixis Investment Managers (Ostrum Asset Management)

Why India presents ample opportunities for companies to align with the UN sustainable development goals (SDGs).India: an ESG landscape in transformation – Federated Hermes Limited

Methane is the second most important gas contributor to climate change after carbon dioxide, but its warming potential is many times greater and addressing…Methane: heating up – Aviva Investors

Ty Lee explores the future of life science tools and how despite current challenging times, the social and environmental impact of these companies cannot…The future of life science tools: from pandemic response to sustainable solutions – WHEB

Mitch Reznick on the key dynamics that underpin the sustainable debt market.The advantages and challenges of ESG in fixed income – Federated Hermes Limited

Posted on Aug 04, 2023T for Triple bottom line – A-Z of impact investing

Deglobalisation, a shrinking working-age population and climate change are set to define the strategic investment outlook.A triumvirate of macro mega-forces – AllianceBernstein

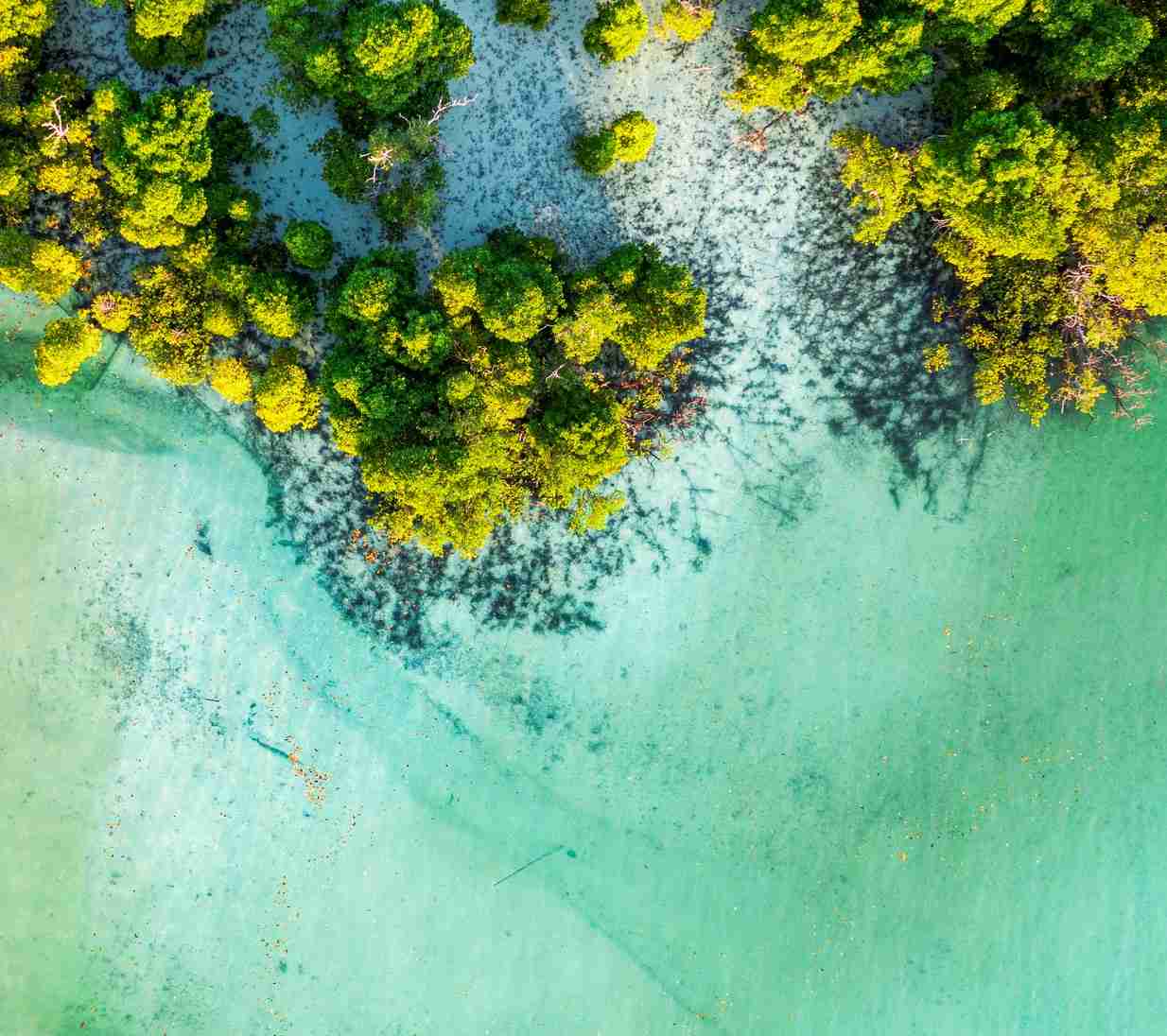

Tackling biodiversity loss is a complex, yet necessary, challenge that any long-term investor must take into consideration.Opportunities and solutions to tackle the main drivers of biodiversity loss – Video – AXA Investment Managers