New accounting standards could revolutionise how we approach net zero investments. Discover how these changes can transform costs into valuable assets.The role of accounting in achieving net zero goals – Charlotte O'leary

Is there a case for investing for impact and risk-adjusted returns in Africa?Investing for climate equity in emerging markets – David Brown

How do fiduciary duties and sustainability objectives intersect?Interpreting fiduciary duty – Bruna Bauer

Charlotte O’Leary, Pensions for Purpose CEO, and Kate Sandle, Director of Sustainability from Newcore Capital, discuss why the investment industry is crucial…This way forward! – B Corp Month 2024 – video

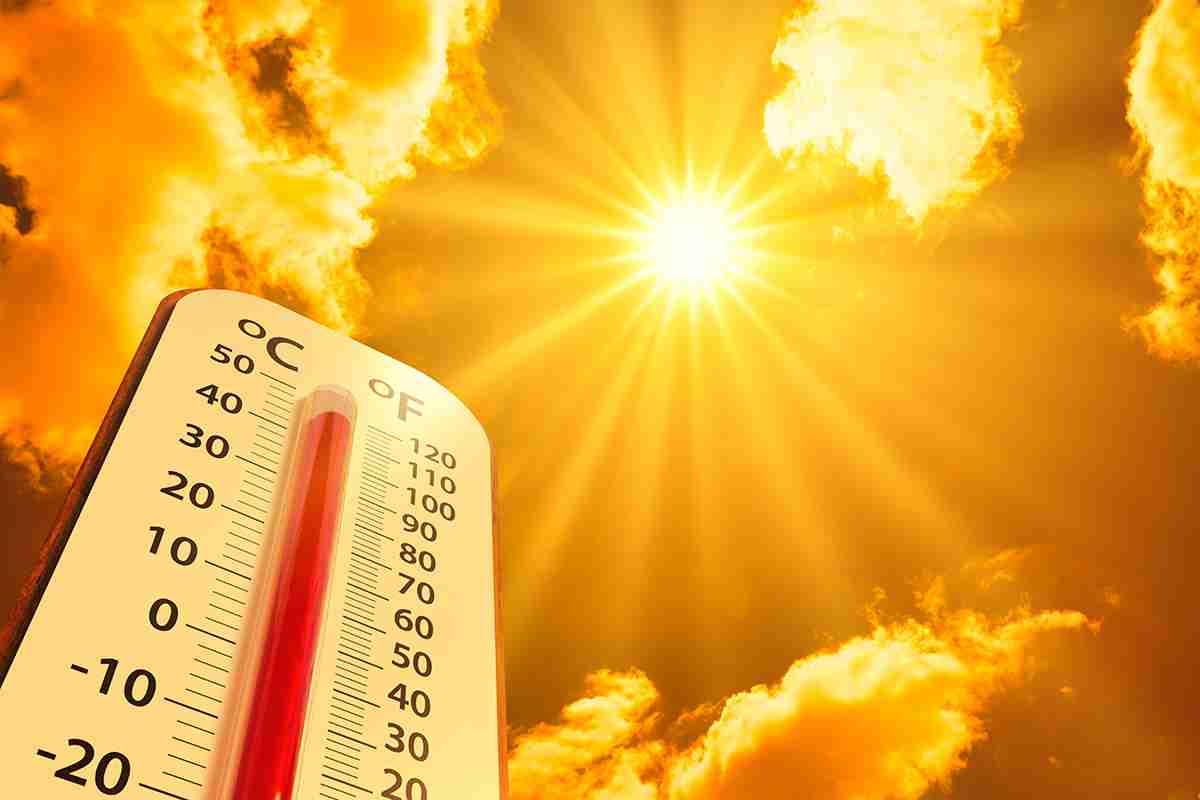

How pension funds can contribute to a wider economic transition.Is net zero the stewardship challenge of our generation? – Bruna Bauer

Column by investment strategist Joeri de Wilde.Anti-woke is a threat to sustainable investing – Triodos Investment Management

How to apply the theory of change to develop impact-led investment thinking and policies.Considering the imperative for impact management – Rachel Lewis

A review of best practice and public sector investment strategies.Is the bar set high enough? – Rachel Lewis

At this Paris Alignment Forum asset owner event, Redington and BP Pension Fund discussed the challenges and outcomes of preparing Climate-related Financial…BP Pension Fund’s approach to TCFD reporting – Juan David Perez