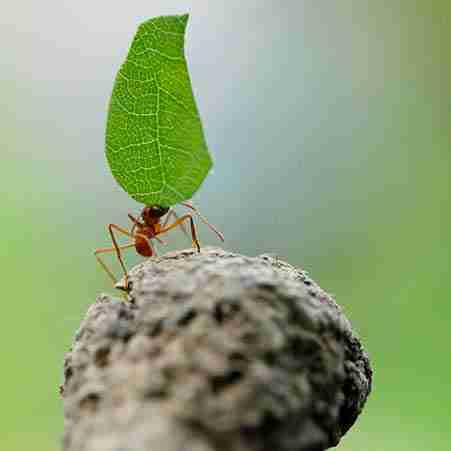

Ants live in colonies consisting of millions. They don't have leaders... they work together collaboratively and effectively because they all have the same goal for the good and unity of the colony. It seems to me, ants have got it right...

To be fair, collaboration is becoming more popular within Local Government Pension Schemes (LGPS). There is a recognition that, by working collaboratively, these funds can be more effective and deliver better value for money for their members. As an independent adviser to four LGPS, I have seen first-hand the benefits of collaboration, and that led to a desire to see the benefits of collaboration working in a different sector:

impact investment.

Impact investments generate a financial return but also have a positive social or environmental impact. For many pension funds, discussion around impact investment is part of their wider ESG (Environmental/Social/Governance) journey and larger schemes are already beginning to allocate to these investments. Yet for many trustees, there is hesitation over whether or not these investments are suitable, given their fiduciary responsibilities.

With this in mind, in October I launched a new platform called

Pensions for Purpose. The aim of this collaborative, web-based initiative is to promote pension funds’ understanding of impact investment by collectively sharing news stories, blogs, case studies, academic research and thought leadership papers on impact topics. The idea was the brain-child of a discussion at The Gathering, an event in February 2017 which brought together 130 of the UK’s most active participants in social investment to discuss the most pressing issues in this sector. At that event, I realised that

the impact investment sector had moved on considerably since the early days of philanthropic investment by wealthy individuals, and I wanted to share that discovery with the pensions community.

Essentially, Pensions for Purpose has two types of members:

Influencers and

Affiliates. Influencers are investment managers involved in impact investment, either for part or all of their business; trade bodies; consultants; and others involved in impact investment who wish to post content on the Pensions for Purpose website. We cover both listed and unlisted assets. Affiliates are asset owners, government bodies, independent advisers and journalists who are interested in understanding more about impact investment. Most of the material on the Pensions for Purpose website is publicly available but signed-up Affiliates can also access additional, exclusive Affiliate-only material plus a regular e-mail with an update of new content, so that they can keep abreast of developments in the marketplace.

There is already some fascinating content on the website. Under

Case Studies, we describe four public sector funds’ impact investment strategies. We also have examples of how impact investments have already had very positive social benefits.

Within

Thought Leadership, there are varied articles from Influencers, including how to introduce an impact investment strategy; environmental issues; impact investment in listed equities; and helping the homeless via property investment. We also have a

Blog page, where members can express personal views, and an

Events section where Affiliates can find out about workshops, seminars and conferences relating to this topic.

Importantly, Pensions for Purpose has a very strict policy that no funds can be promoted on the website, so that it remains a genuine knowledge-sharing platform.

Investment managers behaving in the manner of ants? Well, yes…we do seem to be working together collaboratively and effectively, in this instance. Through Pensions for Purpose, we do all have the same goal for the pensions community and, ultimately, that should result in significant benefits for our society and our environment. And surely that has to be a good thing?