The voluntary carbon market has come under criticism recently after research accusing many offsets of being worthless.Exploring the carbon offset market: issues, reforms and the future – BNP Paribas Asset Management

In a review of the past 12 months, the investment team offers an in-depth view of engagement highlights, progress on milestones, performance and case studies.SDG Engagement High Yield Credit: Annual Report 2022 – Federated Hermes Limited

Mark Nash, Huw Davies and James Novotny explain how they integrate ESG into their macro investment process.ESG integration for macro investors – Jupiter Asset Management

Read our A-Z definitions to stay up to date with impact investment terminology.E for ESG – A-Z of impact investing

How is retail adapting to address the environmental challenges facing the sector?Sustainable fashion: 5 key trends – Gowling WLG

What is biodiversity, why does it matter and how might it affect investment decisions?Biodiversity Q&A: understanding a powerful new investment theme – AXA Investment Managers

In the five years since its launch, the SDG Engagement Equity Strategy has evidentially shown the positive potential of active capital. By investing in…SDG Engagement Equity Annual Report 2022 – Federated Hermes Limited

At an Environmental, Social and Governance (ESG) Summit, held by Professional Pensions, Barnett Waddingham spoke about ESG’s identity crisis.Is ESG a compliance burden? – Barnett Waddingham

Human activity, alongside climate change, has led to increased loss of biodiversity.Shifting the natural cost curve: the role of investors in protecting biodiversity – AXA Investment Managers

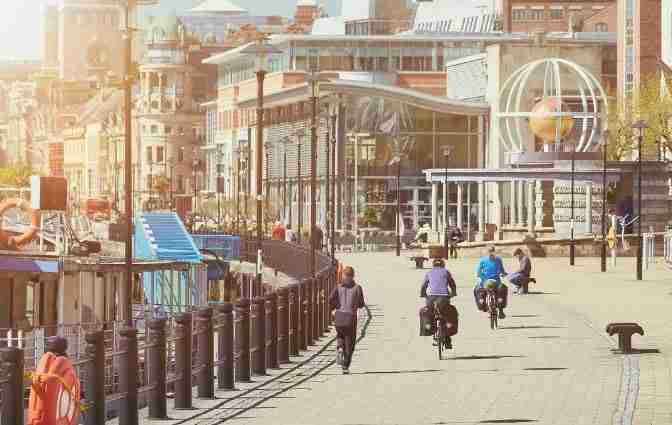

Two of Schroders Capita's real estate experts explain why place-based impact investing and pension fund capital are so well aligned.Q&A: place-based impact investing and how pension capital can help the UK level up – Schroders