2024 marks a pivotal year for sustainable infrastructure investment, driven by decarbonisation, technological advancements, and demographic shifts.2024 investment case for global sustainable infrastructure – Rize ETF

Investors need to rethink net-zero alignment to address current flaws and accelerate progress in decarbonisation.Targeting net zero: 5 reasons to rethink portfolio decarbonisation – Lombard Odier Investment Managers

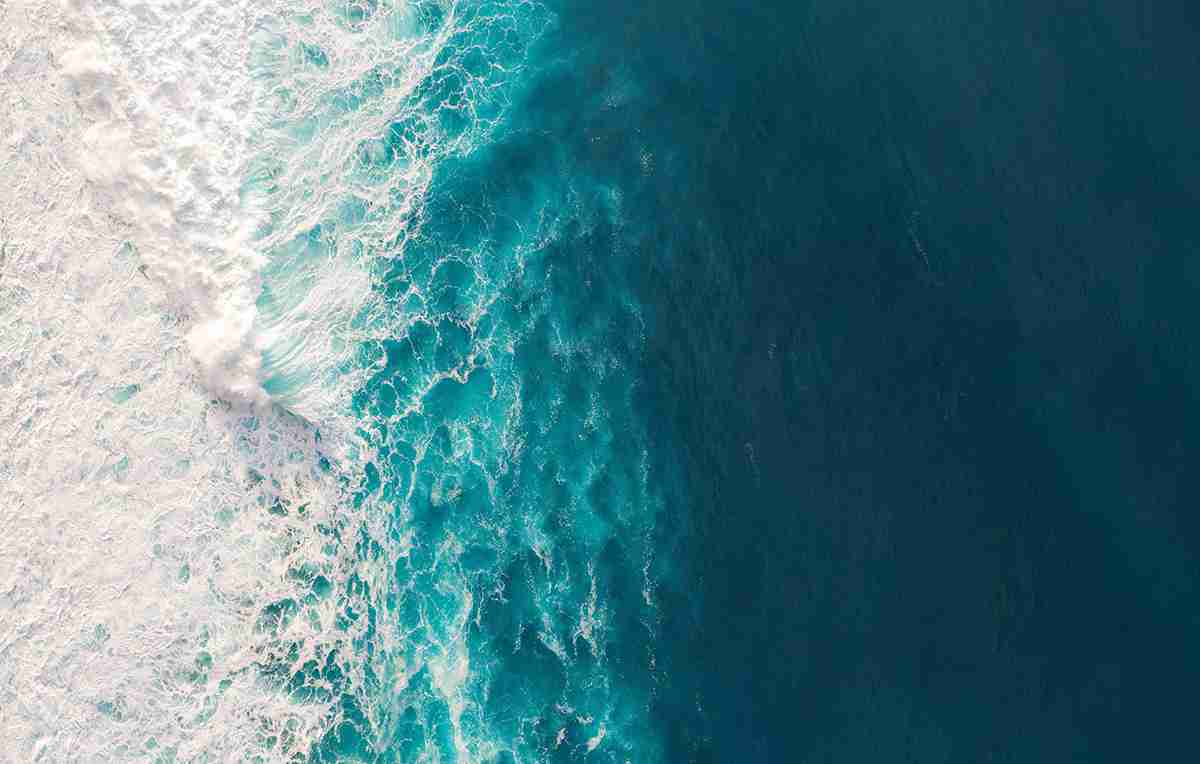

This World Water Day, Liontrust's sustainable future investment fund manager Simon Clements discusses how essential water is for both life and the economy…Why World Water Day matters – Liontrust

This year’s annual report offers a deep dive into a newly augmented data tool that quantifies the progress companies have made towards decarbonisation.Climate Change High Yield Credit, Annual Report 2023 – Federated Hermes Limited

In the second paper of Isio's three-part series on sustainable investment strategy implementation, they present a framework for layering multiple sustainability…Waterfall implementation: layering sustainability objectives in your investment strategy – Isio

How to integrate stewardship in the investment management process.Company engagement is a strong force for change – Triodos Investment Management

Pensions for Purpose and Church of England Pensions Board, Cushon, the Impact Investing Institute, the University of Cambridge and WHEB Asset Management22 May 2024 - All-member online event: affecting real-world impact – a practical framework for Universal Asset Owners

Learn about the challenges faced by sodium-ion batteries and the potential advantages they offer for specific applications.Battle of batteries: sodium vs. lithium ion – Rize ETF

Since 2021 we have been delighted to welcome investment consulting and fiduciary management firms as Adopters of the Impact Investing Principles for Pensions.…Impact Investing Principles for Pensions: Adopters’ evidence full paper 2022

Managing impact in a meaningful way.Why we need to think beyond the numbers – Triodos Investment Management