Discussion topics from Pensions for Purpose’s third Impact Investing Adopter Forum (IIAF) event, run in partnership with the Impact Investing Institute,…Impact Investing Adopters Forum - Impact Investing Principles for Pensions - Principle 3 - Use your voice to make change - Charlotte O'Leary

Spinning the decks on ESG.Hot topics in pensions: Autumn 2021 - Squire Patton Boggs

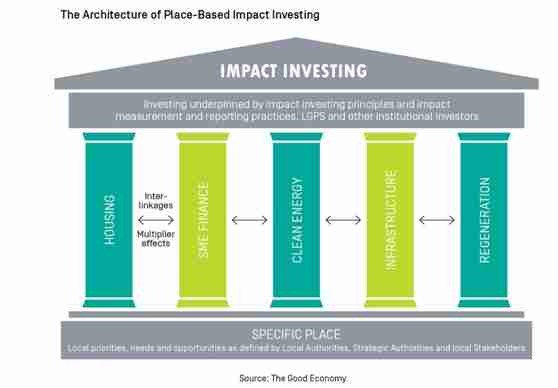

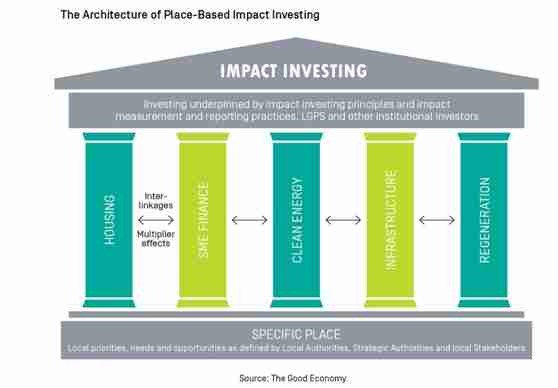

At this asset-owner only discussion, Karen Shackleton (Chair and Founder, Pensions for Purpose) was joined by Debbie Fielder (Clwyd Pension Fund) to discuss…20 October 2021 - Investing in place: an asset owner discussion - Impact Investing Institute and Pensions for Purpose

Much of the food we consume today is bad for our bodies and bad for our climate – and the way it is produced also harms many of the people who make it…Sustainable food production - Artemis Investment Management

At this investment consultant only discussion, Charlotte O'Leary (CEO, Pensions for Purpose), following an introduction by the Impact Investing Institute,…19 October 2021 - Investing in place: an investment consultant discussion - Impact Investing Institute and Pensions for Purpose

If you've been in a queue for petrol or gone to the shop for something as benign as tinned tomatoes only to see the shelves empty, you don’t need to told…We’ve been warned – climate crisis and weak links in the supply chain - WHEB

Welcome to Spectrum – a sustainability focused newsletter that brings together insights from across Federated Hermes' investment floor, including their…Financial inclusion: an economic opportunity for all - Federated Hermes

How investors can reform markets and help combat climate change.From corporate reform to system reform - Aviva Investors

Exploring the hydrogen spectrum.The future's white - Beam Earth

Confused by carbon data and measurement? What’s the reality and what’s the myth? Carbon data and measurement explained.18 October 2021 - Pensions for Purpose Paris Alignment Forum training - Natixis Investment Managers/Mirova