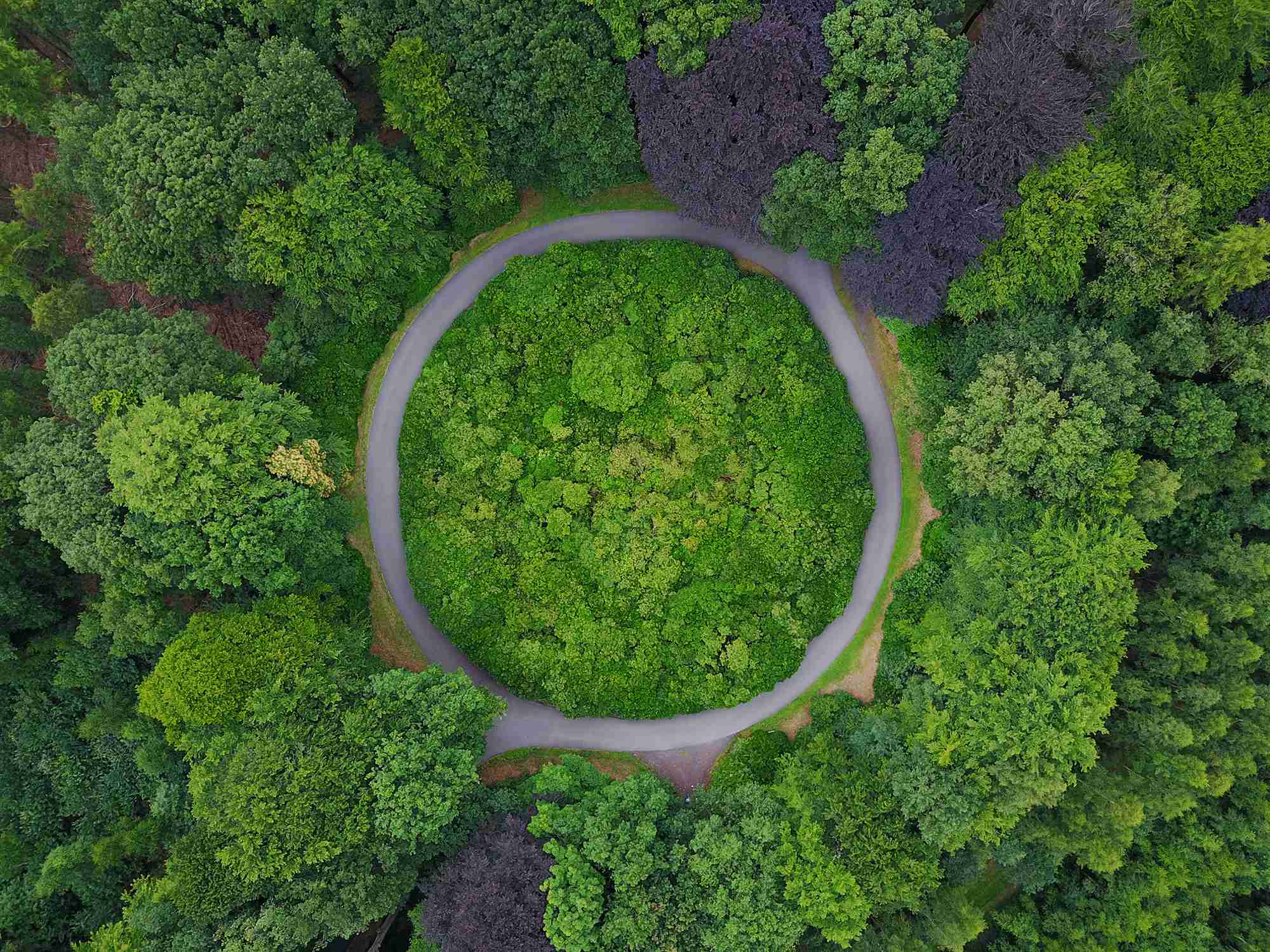

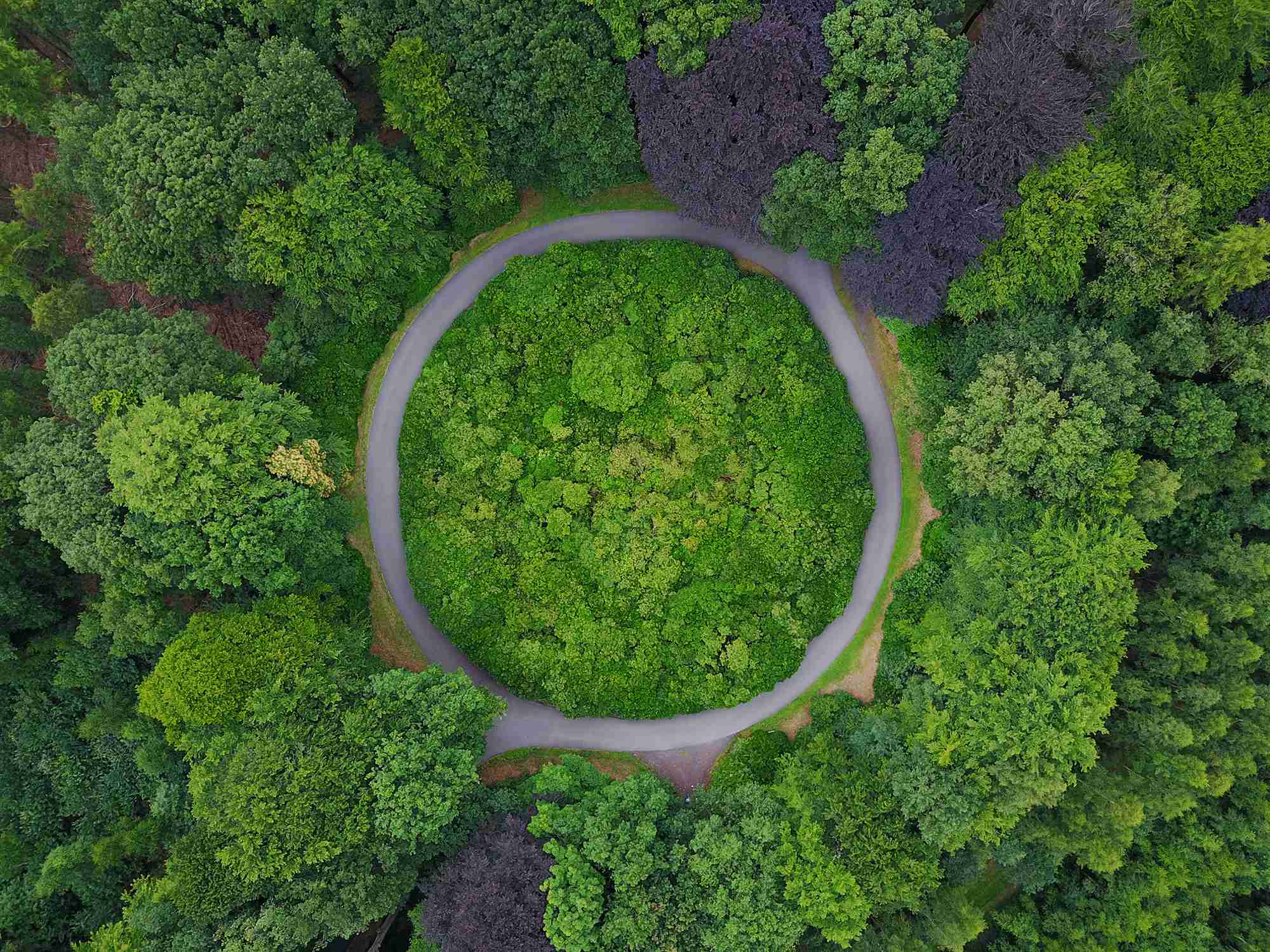

Systemic change is rarely linear.Hope for net zero – Aviva Investors

War in Europe has turbocharged the net-zero agenda. Investors need to be prepared for the risks and opportunities on the path to a carbon-neutral world.Achieving net zero: the path to a carbon-neutral world – J.P. Morgan Asset Management

The green bond universe is an attractive alternative to conventional debt.A word with our expert on green bonds – AXA Investment Managers

A summary of the impact private lending universe.Impact private lending at a glance – Redington

As people and planet face greater challenges: global warming, the COVID-19 pandemic, and inequality – ESG efforts are increasingly focusing on real world…ESG report 2021 – LGT Capital Partners

A webinar from Reuters on active share ownership and engagement, with Karen Shackleton of Pensions for Purpose as a guest speaker.12 May 2022 – From riding the ESG wave to setting the scene: harness the power of active ownership - Reuters Events

In this latest update on the Sustainable Global Equity strategy, fund manager Martin Todd asks: Is ESG inflationary?Sustainable Global Equity Report, Q1 2022 – Federated Hermes

The world is now suffering a major price shock as inflation creeps in.Food inflation: the broad and the narrow view – ARK Invest Europe

How to integrate impact investment.11 May 2022 – Impact Investing Adopters Forum online asset owner event – Surrey Pension Fund

A fresh perspective on defined contribution pensions.The Defined Contrarian, Q1 2022 – Redington